The Tax Returns filing season for FY23 is here, and taxpayers now have the option to choose between two tax regimes: the Old Regime and the New Regime. But to do that, taxpayers now need to be aware of the advantages and limitations of each regime.

So, let’s understand both options and then you can decide which option is best for you. We’ll break down the details to help you make an informed choice for a smoother tax experience this year.

To begin with, the Old Regime offers higher deductions and exemptions. The New Regime however provides a lower tax rate. Both options offer different benefits for different taxpayers.

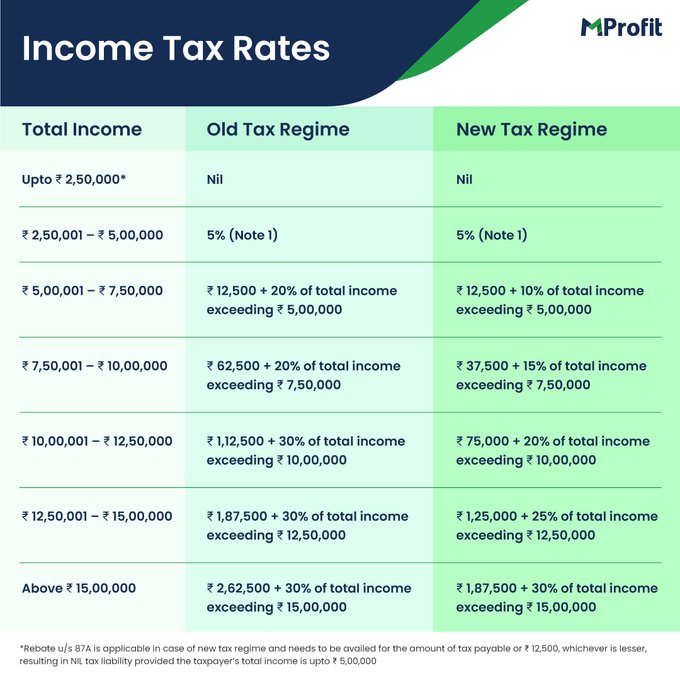

Here is a comparison snapshot between the two regimes:

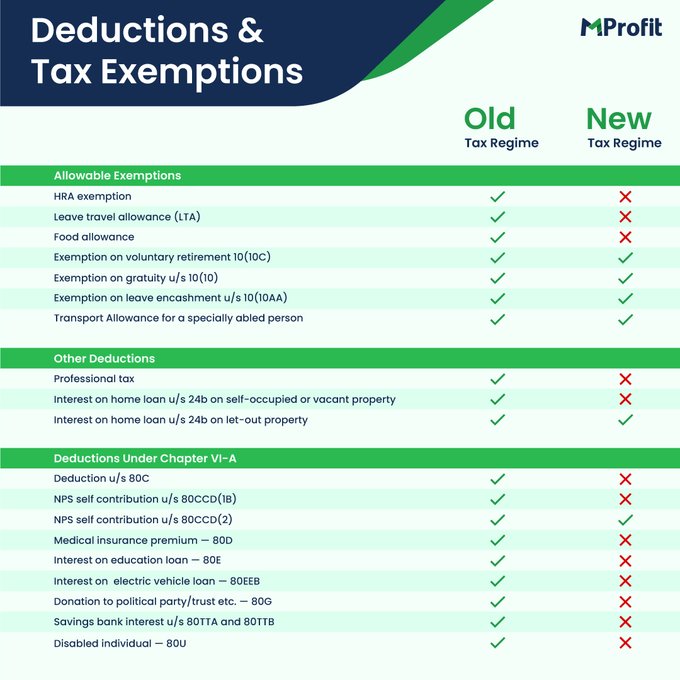

Under the New Regime for example, certain deductions like House Rent Allowance (HRA), Leave Travel Allowance (LTA), and section 80C deductions cannot be claimed, thereby impacting the overall tax liabilities and requiring a different approach for calculating taxable income.

Here is a list of deductions available under the Old & New Regimes:

For FY23, the old regime is the default option but an individual can choose to opt for the new regime. However, from April 1, 2023, the new tax regime has become the default tax regime.

Let’s talk about the advantages and limitations of each regime.

The Old Regime

Advantages:

- Many deductions are available, including travel and house rent allowance

- Deductions under Income Tax Act’s Chapter VI-A, including Section 80C, 80D

- Tax deduction on the interest component of a home loan for vacant or self-occupied property

Limitations:

- The tax slab rates are higher compared to the new regime

- Tax-saving instruments may have long lock-in periods

- Filing returns can be complex due to the numerous deductions

- The tax slab rates are higher compared to the new regime

The New Regime

Advantages:

- Lower tax slabs

- Reduced tax compliance

- Decreases the complexity of tax filing

- As no tax-saving products are allowed, it helps individuals to invest in products as per the risk profile

Limitations:

- The New Regime does not offer as many exemptions or deductions. For instance, the HRA deduction is not available

- Absence of incentives for tax-saving products may bring down investments in these products

Choosing the Right Regime

To make an informed decision, consider your eligible deductions and exemptions in the old regime. If your deductions exceed the break-even threshold for your income level, the old regime may be better.

Otherwise, the new regime could be more beneficial. It’s important to inform your employer about your choice to ensure accurate TDS deductions.

Remember, the choice between old and new regimes depends on your specific income and deductions. To help determine the suitable regime for you, let’s consider a couple of examples:

Example 1: Atul has an income of Rs. 7.50 lakhs with Rs. 2.50 lakhs in deductions (section 80C + HRA) in FY23.

- Under the Old Regime: The taxable income would be Rs. 5 lakhs, resulting in zero tax liability.

- Under the New Regime: The tax would amount to Rs. 39,000.

In this case, sticking to the Old Regime makes sense as deductions bring down taxable income.

Example 2: Neha has an income of Rs. 9 lakhs and claims no deductions in FY23.

- Under the Old Regime: The tax payable would be Rs. 96,200.

- Under the New Regime: The tax payable would be Rs. 62,400.

In this example, as there are no deductions, the New Regime offers a lower tax liability.

When choosing between the Old Regime and the New Regime, consider your deductions and exemptions. If you have fewer exemptions, the New Regime may be a better fit.

Remember, everyone’s tax situation is different, so it’s wise to seek advice from a tax expert.

Wishing you a stress-free tax filing season!

Comments