Introduction

In the realm of taxation in India, Section 80C stands as a well-known avenue for individuals to save on their tax liabilities through eligible investments under the old tax regime. It allows you to reduce your taxable income by investing in specific financial instruments.

One of the key attractions of Section 80C is that it offers tax exemptions of up to Rs 1,50,000.

In this guide, we provide you with an intuitive breakdown of some of the popular investment products that fall under Section 80C, along with their key features.

Common investment products that fall under Section 80C, along with their key features:

1) Equity Linked Saving Scheme (ELSS):

ELSS is a type of mutual fund that primarily invests in equities or stocks. One noteworthy aspect is that it comes with a minimum lock-in period of 3 years. This means that once you invest in ELSS, you cannot withdraw your money for at least three years.

2) Provident Fund (PF):

The Provident Fund is a government-managed retirement savings scheme designed for employees and citizens. It involves a portion of your salary being contributed during your employment. It’s primarily a fixed-income product and has a long lock-in period of 15 years.

3) Tax-Saving Fixed Deposit (FD):

Similar to a regular fixed deposit in a bank, a tax-saving fixed deposit allows you to invest your money. However, it comes with a lock-in period of 5 years, meaning your funds remain locked for this duration.

4) National Savings Certificate (NSC):

The NSC is a fixed-income investment scheme that you can open at any post office branch. Like the tax-saving fixed deposit, it also has a lock-in period of 5 years.

5) Sukanya Samriddhi Yojna (SSY):

Sukanya Samriddhi Yojna aims to secure the future of a girl child. It has a notably long lock-in period of 21 years, making it a suitable option for long-term savings for education or marriage.

6) Senior Citizens Savings Scheme (SCSS):

Designed for individuals above the age of 60, this government-managed savings scheme allows a maximum investment of Rs. 30 lacs.

7) Unit Linked Insurance Plan (ULIP):

ULIP is a unique plan that combines investment and insurance. It enables you to invest towards your financial goals while providing insurance coverage in case of unforeseen events. The lock-in period for ULIPs is 5 years.

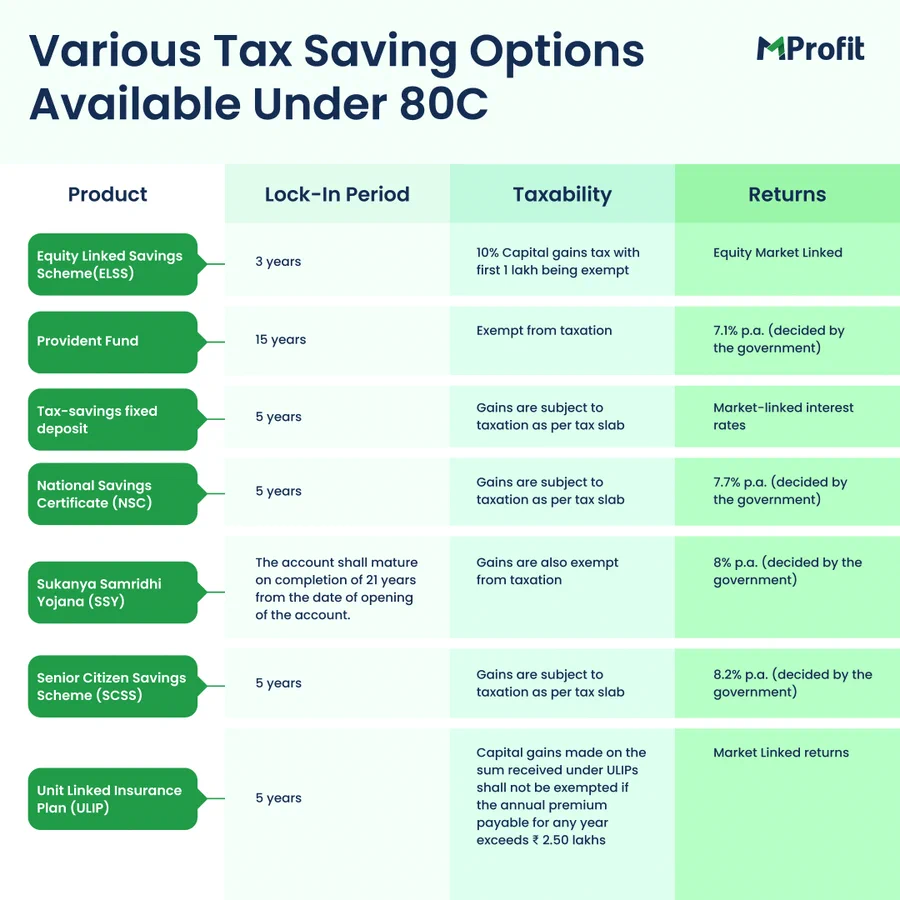

Below is a snapshot summarizing the key features of these products eligible for tax exemptions under Section 80C:

Conclusion

Section 80C provides a range of investment options to help you save taxes while working towards your financial goals.

Each of these options has its own characteristics and lock-in periods, so it’s essential to choose the one that aligns with your financial objectives.

Make sure to consult with a financial advisor and carefully assess your investment needs before making any decisions.

Know more about the types of investments available in India to make informed decisions.

Comments