The Mutual Fund Factsheet houses crucial details about the scheme, encompassing its objectives, portfolio, risks, returns, & more.

In this blog, we delve into the key indicators in the MF Factsheet that shed insights into debt and related mutual fund schemes.

The Mutual Fund Factsheet includes quantitative parameters that provide statistical insights into a mutual fund’s performance, composition, and structure.

Here are a few important metrics to look out for while making investment decisions in debt mutual funds:

Investment Objective

This defines the fund’s primary goals like income generation, capital appreciation, etc.

Debt schemes can operate across maturities from one day to many years, and each carries different risk levels. Hence, understanding the fund’s investment objective helps you to make informed decisions that align with your financial goals, risk tolerance, and investment horizon.

Duration

Duration measures how bond prices are affected by changes in interest rates.

Bond prices are inversely proportional to interest rates, i.e. when interest rates rise, bond prices fall.

On the other hand, when interest rates fall, bond prices rise.

Higher Duration indicates higher bond price volatility in response to interest rate changes.

Duration also indicates the average maturity of all bonds held in a debt mutual fund’s portfolio.

A duration of 2.4 years indicates the time it takes for the entire portfolio to be repaid.

Thus, duration is crucial in analysing debt mutual funds.

Yield to Maturity

YTM is the expected total return if all bonds are held till maturity and

all interest payments are re-invested.

Example: YTM is 8.91%

This means if you invest today, you can expect 8.91% returns,

provided you hold the debt fund till maturity.

Credit Ratings

The credit ratings highlight the creditworthiness or risk of the bonds in the fund’s portfolio.

These ratings range from AAA (highest credit quality) to D (default), indicating different levels of credit risk.

The factsheet contains the credit rating of the entire portfolio.

This helps understand the quality of credit in the debt scheme.

Also, monitoring changes in credit ratings over time can provide insights into potential shifts in the fund’s risk profile and performance.

Expense Ratio

This is a percentage that denotes the fee paid to the AMC to manage your investments.

i.e. the per-unit expense of operating and managing the mutual fund.

MF Factsheet also tells you some important facts about the scheme like:

Fund Manager’s Name

In actively managed schemes, a fund manager plays a crucial role in managing the money pooled in by investors.

Any change in the fund manager is updated in the factsheet.

Assets Under Management (AUM)

It is the total money managed by the scheme on behalf of the investors.

AUM is a significant metric used to assess the size and scale of an Asset Management Company (AMC) and its ability to manage assets for its clients.

Portfolio Holdings

Portfolio holdings refer to the bonds, cash equivalents, or other financial instruments that the fund owns.

Understanding portfolio holdings helps investors comprehend the fund’sdiversification, risk exposure, and investment strategy.

Entry and Exit load

It is the fee charged by the fund house at the time of buying or selling the MF units.

These loads are subtracted from the invested amount or the redemption proceeds, reducing the returns for investors.

Returns

The factsheet contains the scheme returns since inception and returns wrt to the benchmark for a specific period.

It is crucial to note that a fund’s past performance does not guarantee future returns.

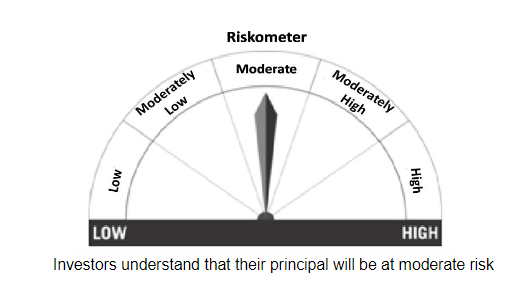

Riskometer

The riskometer scale represents the risk associated with the scheme as per SEBI product labelling guidelines.

Each scheme is assigned a specific position on the scale based on its risk profile, & factors such as volatility, market risk, liquidity, etc.

Conclusion

The Mutual Fund Factsheet is an excellent tool which the AMC publishes for every scheme each month. One must always read the factsheet before investing and make informed decisions based on your financial goals and risk-return profile.

Read our blog to know about types of debt mutual fund schemes with different maturities and risk levels.

*Disclaimer – This is for informational purposes only and not an investment advice.

Comments