Health insurance portability is a valuable feature that allows individuals to switch between health insurance providers or policies without losing their accrued benefits.

In this article, we’ll explore health insurance portability, its associated benefits and considerations, and when and how to use it.

What is Health Insurance Portability?

Imagine purchasing a health insurance policy only to realize later that its terms and conditions are unfavourable, such as Room rent limit, Co-pay or is not a comprehensive policy.

In such situations, health insurance portability comes into play.

It enables you to transfer your existing policy to either another policy within the same insurance company or to a policy offered by a different insurer.

Benefits of Porting

- Continuity Benefits: When you port your health insurance policy, your continuity benefits remain intact. This means that the waiting periods you’ve already served for specific illnesses, treatments, or pre-existing conditions will be honoured by the new insurer.

- Waiver of Waiting Periods: Waiting periods for certain treatments or pre-existing diseases are typically waived off when you port your policy. For instance, if you’ve already served a waiting period for a particular condition, you won’t have to start over when you switch insurers.

- Moratorium Period: The moratorium period, during which certain pre-existing conditions are not covered, continues to apply even after porting your policy.

- Improved Terms and Conditions: Portability allows you to move to a policy with better terms and conditions, such as higher coverage limits or additional benefits.

Facts about Porting 👇

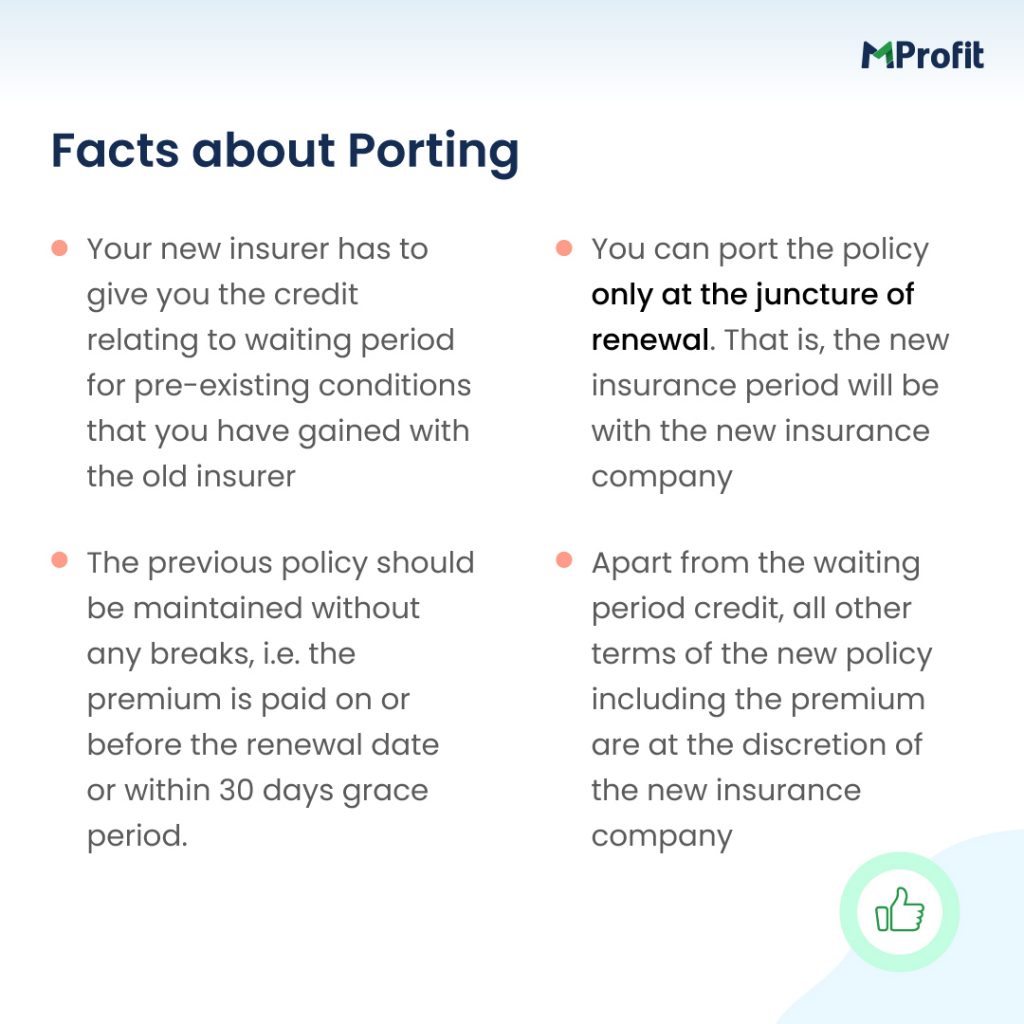

Health insurance policies often come with waiting periods for specific illnesses, treatments, and pre-existing diseases.

For instance, covers like cataracts may kick in only after two years of coverage, while pre-existing disease coverage might start after three to four years.

When you purchase a new policy, these waiting periods reset.

However, porting your policy ensures continuity benefits. This means the waiting periods you’ve already served will remain intact with the new insurer.

Illustrative Example

Let’s consider Mr. X, who bought a health insurance policy declaring hypertension, which has a waiting period of three years.

Four years later, Mr. X wants to purchase another policy without a room rent limit.

If he opts for a new policy, the waiting period of three years for hypertension will reset.

However, by porting his existing policy, Mr. X can retain his continuity benefits, and the new insurer will not apply a waiting period on hypertension.

Checklist for Health Insurance Porting👇

When to Port a Policy?

Before deciding to port your health insurance policy, carefully review the terms and conditions of your existing policy.

If you have a comprehensive policy that meets your needs, there may be no need to switch.

However, if you find a better policy with superior terms at an affordable premium, porting could be advantageous.

During Underwriting

It’s essential to be aware that during underwriting if you are diagnosed with lifestyle diseases like hypertension or diabetes, the insurer may adjust the premium accordingly.

Additionally, frequent policy porting can lead to other complications, so it’s crucial to weigh the pros and cons carefully.

How to port a policy?

Here is a complete guide on how to port a policy👇

Health insurance porting can be a valuable strategy for maintaining continuity benefits and avoiding waiting periods for pre-existing conditions.

By understanding the process and considering your individual circumstances, you can make informed decisions to ensure your healthcare needs are adequately covered.

*Disclaimer – This is for information purposes only and not investment advice. Data credit to the rightful source.

Comments