As per the new Finance Bill, it seems that Taxation rules for Mutual Funds might be changing in the near future. It seems that starting 1st April 2023, gains on Debt Mutual Funds might no longer receive a long term benefit with indexation, and they’ll be taxe as per one’s income tax slab rate.

If this change is indeed confirmed, be rest assured that we will accordingly update our Capital Gain reporting in MProfit!

And while we are on the topic, why not a quick refresher on Capital Gains and how MProfit can help you automate this?

If you are short on time, kindly note the following 4 points to automate your Capital Gains:

- You can directly import your trade files to MProfit from 700+ stockbrokers, Mutual Fund CAS, PMS statements & more!

- MProfit then provides you ready-made Capital Gain reports in ITR format.

- MProfit also provides you with Capital Gains in formats compatible with tax portals: Income Tax Portal, ClearTax, Winman & more.

- MProfit also computes your Unrealised Capital Gains before you decide to sell any Stocks, MFs and Traded Bonds.

Now, if you have the time to learn more about Capital Gains, please read ahead.

Key points to keep in mind:

- You must report Capital Gains on assets for which you make a sale in a given year

- Capital Gains are of 2 types: Long-term and Short-term

- Intra-day (speculative) gains / losses are to be filed separately as Income and taxed as per your Income Tax slab rate

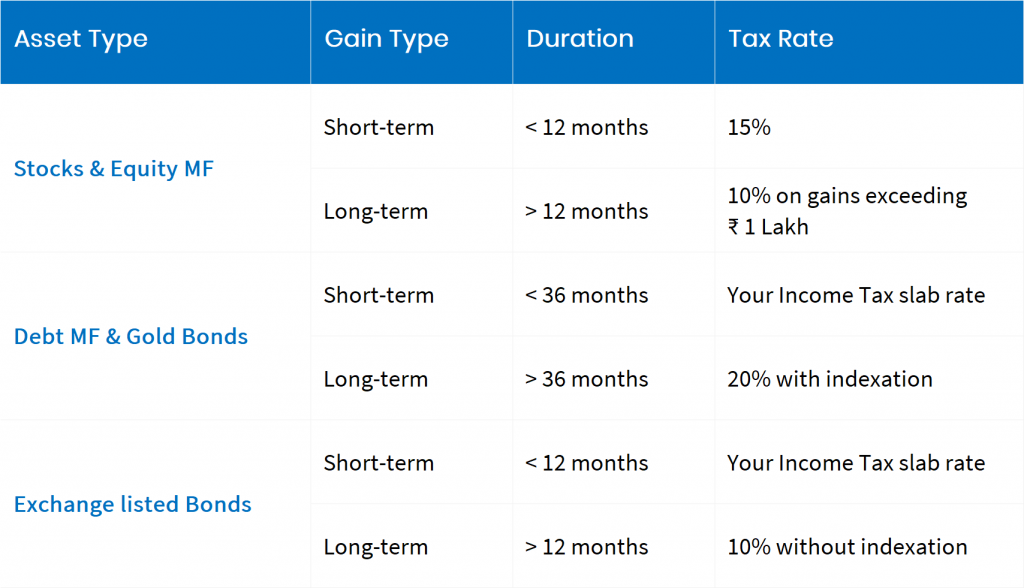

Current taxation structure for FY 2022-2023:

The guidelines below are for FY 2022-23. We will update you separately about changes for the next FY.

Simple enough so far? Here’s some more detail

You must compute Capital Gains using the First-In-First-Out method. Simply put, this means that when you sell your shares, you sell your oldest shares first and compute Capital Gains accordingly.

Second, you must account for any applicable corporate actions (like Bonus, Split, Merger or Demerger) while computing Capital Gains for stocks.

MProfit provides an awesome feature that auto-applies corporate actions for your Stocks. While computing your capital gains, we also properly handle each corporate action.

Everyone’s talking about Indexation. But what is it?

Indexation simply put is a means to adjust the cost price of an investment to reflect the impact of inflation on it. This is done to pass on a benefit to investors by considering the effect of inflation on investment returns!

For FY 2022-23, you can get an indexation benefit on your Capital Gains for Debt Mutual Funds and Gold Bonds, as per India’s Cost Inflation Index (CII). Capital Gains in MProfit currently adjust for Indexation where applicable, by using the latest CII data.

And if debt mutual fund taxation guidelines are changing in the near future, we will update our capital gain reporting accordingly. Be rest assured!

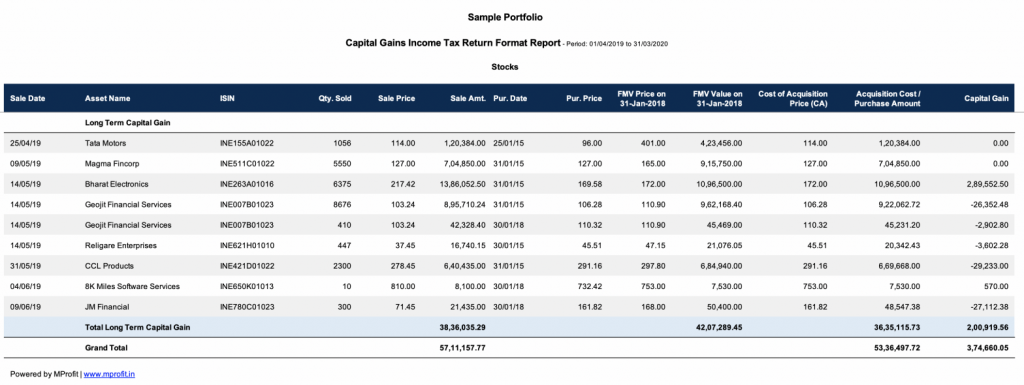

MProfit provides Capital Gain reporting for your Stocks, Mutual Funds, Traded Bonds, REITs and InvITs!

Here’s what a sample Capital Gain report in MProfit looks like:

Income Tax guidelines are dynamic and investors must adapt!

Last week exemplifies the fact that taxation will always be an evolving topic and that investors must adapt, in order to comply with the latest guidelines.

If you’re an MProfit user, you don’t need to worry! We take care of the details.

Regardless of whether you file your return directly or via a CA, MProfit makes the computation of Capital Gains seamless & automated, as per the latest IT guidelines.

To learn more on the proposed changes to Mutual Fund taxation, read this detailed article.

Comments