In the world of investing, there has been a massive shift in recent years towards passive mutual fund strategies, specifically index funds.

With the growth of the internet and ease of access to financial education, more investors are becoming aware of the advantages of low-cost, diversified investing.

Active vs. Passive Funds

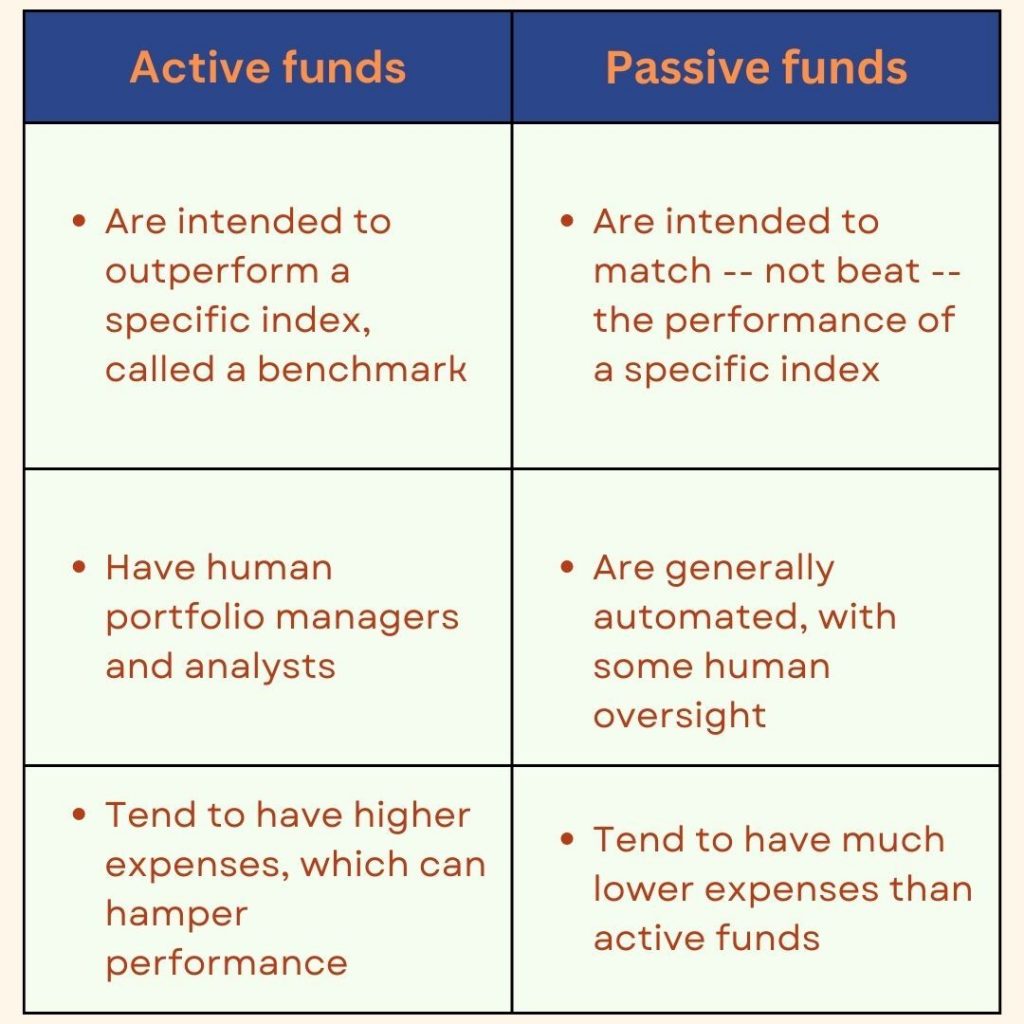

First, let’s differentiate between the two primary investment strategies: active and passive.

Active investing involves a hands-on approach with a portfolio manager striving to outperform the market’s average return.

Passive investing, on the other hand, involves taking a non-active approach by investing in a diversified portfolio with low costs and a long-term horizon, aiming to match the market’s average return.

The rise of Index Funds

One type of passive investment strategy that has gained significant popularity is index funds. Index funds invest in stocks that mimic a stock market index, such as Nifty or Sensex. These funds are passively managed, meaning the fund manager invests in the same securities present in the underlying index, in the same proportion.

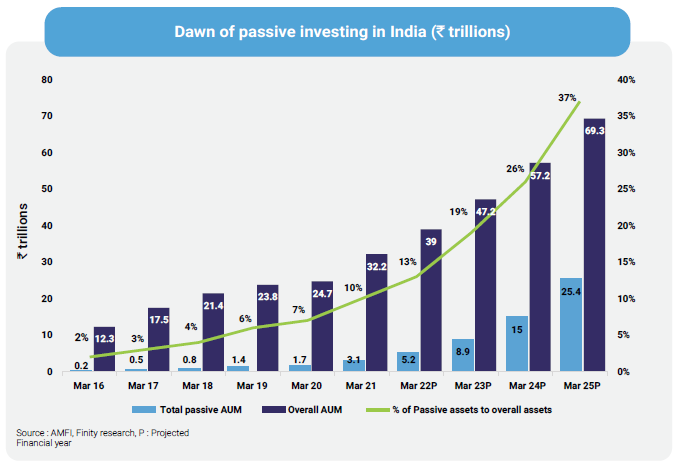

Recent reports suggest that passive assets under management (AUM) could grow to ₹ 25 trillion by 2025, potentially representing 37% of overall assets in the MF industry. This significant growth highlights the appeal and advantages of index funds for investors.

Why Index Funds are attractive to investors

- Cost: Active funds typically charge higher fees between 0.8% to 1.2% of AUM on Direct Plans. In contrast, index funds are available for as little as 0.06% to 0.30% of AUM. This low cost is especially beneficial for long-term investors who can avoid the drag of high fees on their investment returns.

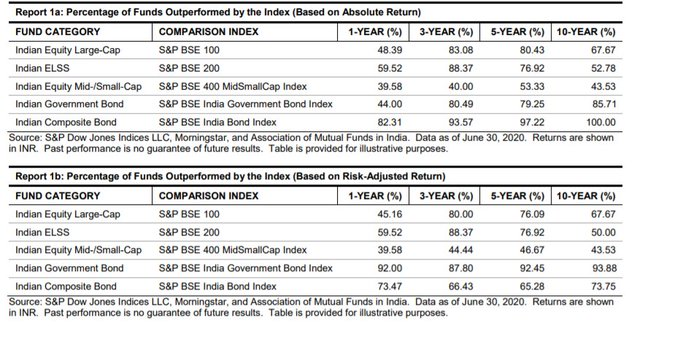

- Performance relative to benchmark: While there is no guarantee that an active fund will outperform, higher fees may put additional pressure on a fund manager to achieve above-average returns. However, reports suggest that approx. 67% of large-cap funds may have underperformed the index over the last decade. In contrast, index funds aim to match the benchmark index’s performance, with minimal deviations.

- No bias investing: By adhering to an automated, regulation-based investment strategy, index funds eliminate the influence of human discretion and bias when making investment decisions. This ensures investors can capture broad market returns without the potential of underperformance caused by human decision-making.

- Broad market investing: Index funds invest in a proportion similar to that of an index, ensuring the portfolio is diversified across all sectors. As a result, an investor can capture the potential returns of a larger market segment through a single index fund.

What to keep in mind when investing in Index Funds

While index funds provide numerous advantages, it is crucial to keep in mind certain factors when investing in them.

Firstly, tracking error (TE) measures the difference between the return of the index fund and the benchmark index it is tracking. Secondly, there is little or no room for alpha in index funds.

By investing in an index fund, the investor is accepting returns that are in line with the index the fund is tracking.

Conclusion

In conclusion, investors should consider a mix of both active and passive funds in their portfolios.

Index funds are an attractive strategy for low-cost, passive equity mutual funds that decrease the likelihood of underperforming the benchmark. Index funds provide an effective and straightforward approach to capture broad market returns with minimal cost and risk.

Comments