Every year, regardless of whether markets perform or not, investors often find themselves scrambling to compute and report capital gains accurately and on-time. One thing we can all agree on is how enormously tedious this process can be. So let’s break it down. What are the key things you need to keep in mind?

- You must compute and report your capital gains every year on every asset in which you sell units / shares

- Capital gains are of 2 types – Long-term and Short-term

- Intra-day (speculative) gains / losses are not treated as capital gains; they are filed separately as Income while filing returns and they are taxed as per your Income Tax slab rate

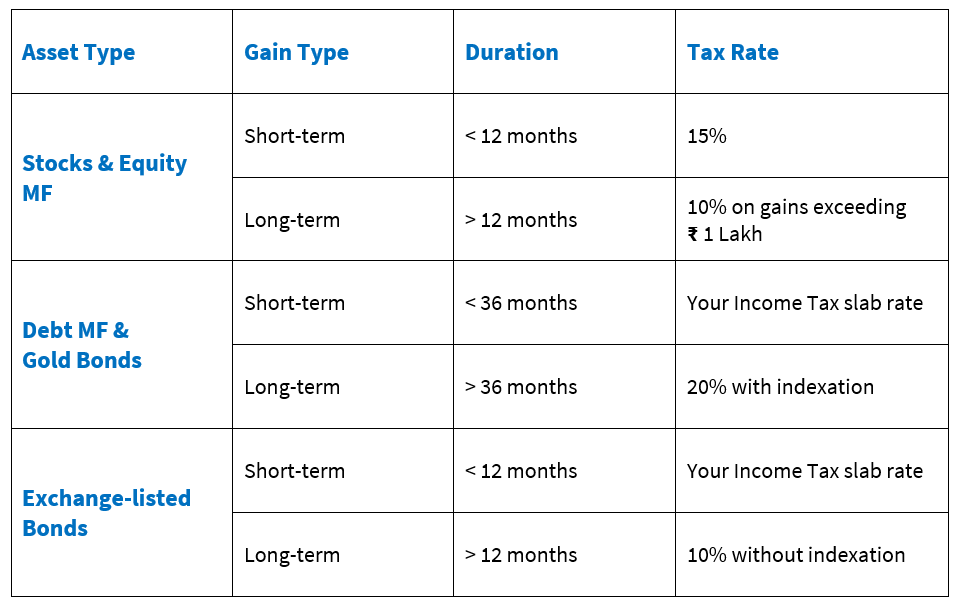

- Below is an overview of capital gains on different assets and their corresponding tax rates:

Simple enough thus far? Here’s where it gets a little complicated:

Firstly, capital gains must be computed using the First-In-First-Out method. Simply put, this means that when you sell your shares/units, you sell your oldest shares/units first and do your calculations accordingly.

Second, you need to account for various Corporate Actions while computing capital gains as per Income Tax rules; these transactions include Bonus, Split, Merger and De-merger.

Third, for Debt MF & Gold Bonds, you must compute your capital gains with Indexation. To add to this, capital gains on Debt MF & Gold Bonds sold after April 1st 2017 must use revised CII numbers with the updated base year of 2001, as recently mandated in Budget 2017.

And now for the trickiest part: Grandfathering

In 2018, the Indian Government introduced a 10% LTCG tax on Stocks and Equity MF with the caveat that any gains accumulated until January 31st 2018 will not be taxed. This is where the complexity of grandfathering capital gains comes into play.

Your Stock and Equity MF long term capital gains on assets sold on or after April 1st 2018 are now subject to Grandfathering.

This means that for any such assets that you have held prior to January 31st 2018, you must deduce the real Cost of Acquisition (CA) by comparing your original Purchase Price (PP) and your Selling Price (SP) with the price of the asset on January 31st 2018 (FMV). For a more detailed overview of Grandfathering, click here.

Not only is this an immensely tedious process, accounting for corporate actions also complicates things further.

For example, if you’ve held Bharat Electronics since August 2015 and its price on 31st January 2018 was ₹ 169. Now if Bharat Electronics were to declare a stock split in the ratio of 1:2, your FMV will consequently change and this could also change your Cost of Acquisition for Bharat Electronics.

In this example, we have only one security with one corporate action. But you might hold a large portfolio comprising many stocks and mutual funds, each with a history of multiple corporate actions. You can realize how enormously difficult it is for you to calculate your Grandfathered gains for all your holdings.

How MProfit helps?

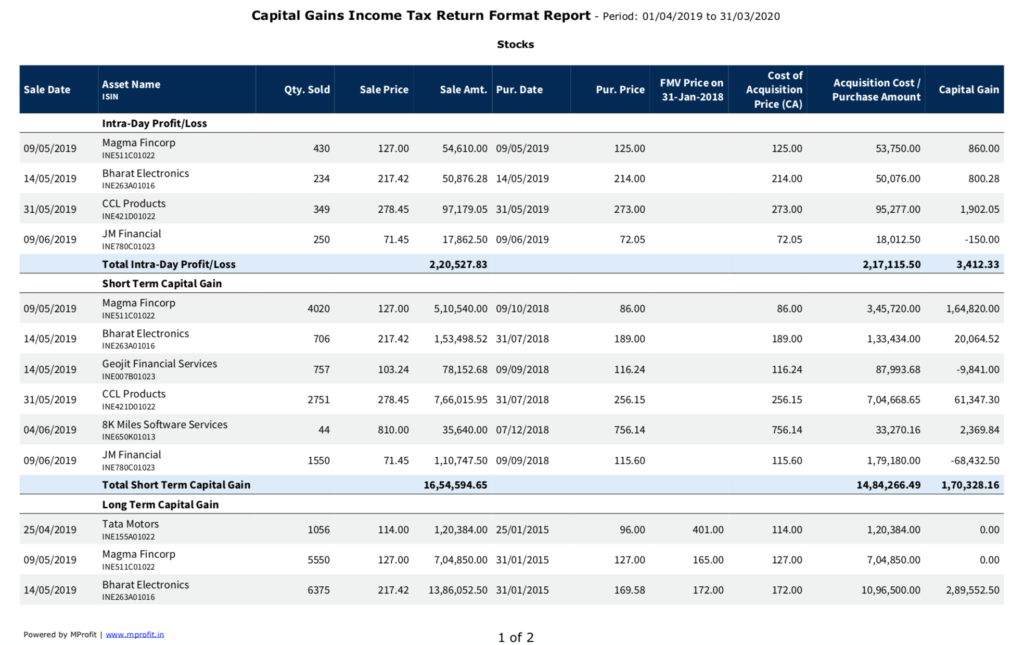

In addition to accurately computing your capital gains on stocks, mutual funds and traded bonds (with indexation), MProfit supports capital gains with Corporate Actions and Grandfathering for all Stocks and Equity MF. MProfit also gives you detailed Capital Gain reports, including one that presents your gains sorted by long-term, short-term and intra-day in an Income Tax Return (ITR) format (see image below). You can simply provide this to your CA for tax-filing purposes.

MProfit keeps up-to-date with the latest regulatory changes. For instance, to help you stay current with a recent mandate, MProfit gives you ISIN details for all assets in our Capital Gains ITR Format report. If you are an MProfit user, you do not need to tediously procure such details yourself. MProfit helps you ensure that your returns filed are accurate and saves you a significant amount of time while doing so!

So here’s what you need to do:

- Click here to download MProfit now on a Windows computer

- Import your investment data to the MProfit desktop application from any of our 3500+ supported file formats

- Sync your portfolio data to MProfit Cloud and start tracking your MProfit portfolios on Web & Mobile

- On a web browser, sign in to MProfit Cloud and download your current year Capital Gains Income Tax Format Report for Stocks, Equity Mutual Funds and Traded Bonds.

- You’re all set! You can now take these reports to your CA for tax-filing.

Always know that our Support Team is here to help! If you have any questions, give us a call at (022) 4002-4149 during our business hours or email us anytime at support@mprofit.in and we will respond to you shortly.

Comments