Every year, regardless of how markets move, investors are faced with one constant challenge:

The complex task of accurately computing Capital Gains

This can often be a tedious and time-consuming process, prone to error. So let’s break it down.

What are the key things you need to know?

- You must report Capital Gains on every asset for which you make a sale in a given year

- Capital gains are of 2 types: Long-term and Short-term

- Intra-day (speculative) gains / losses are to be filed separately as Income and taxed as per your Income Tax slab rate

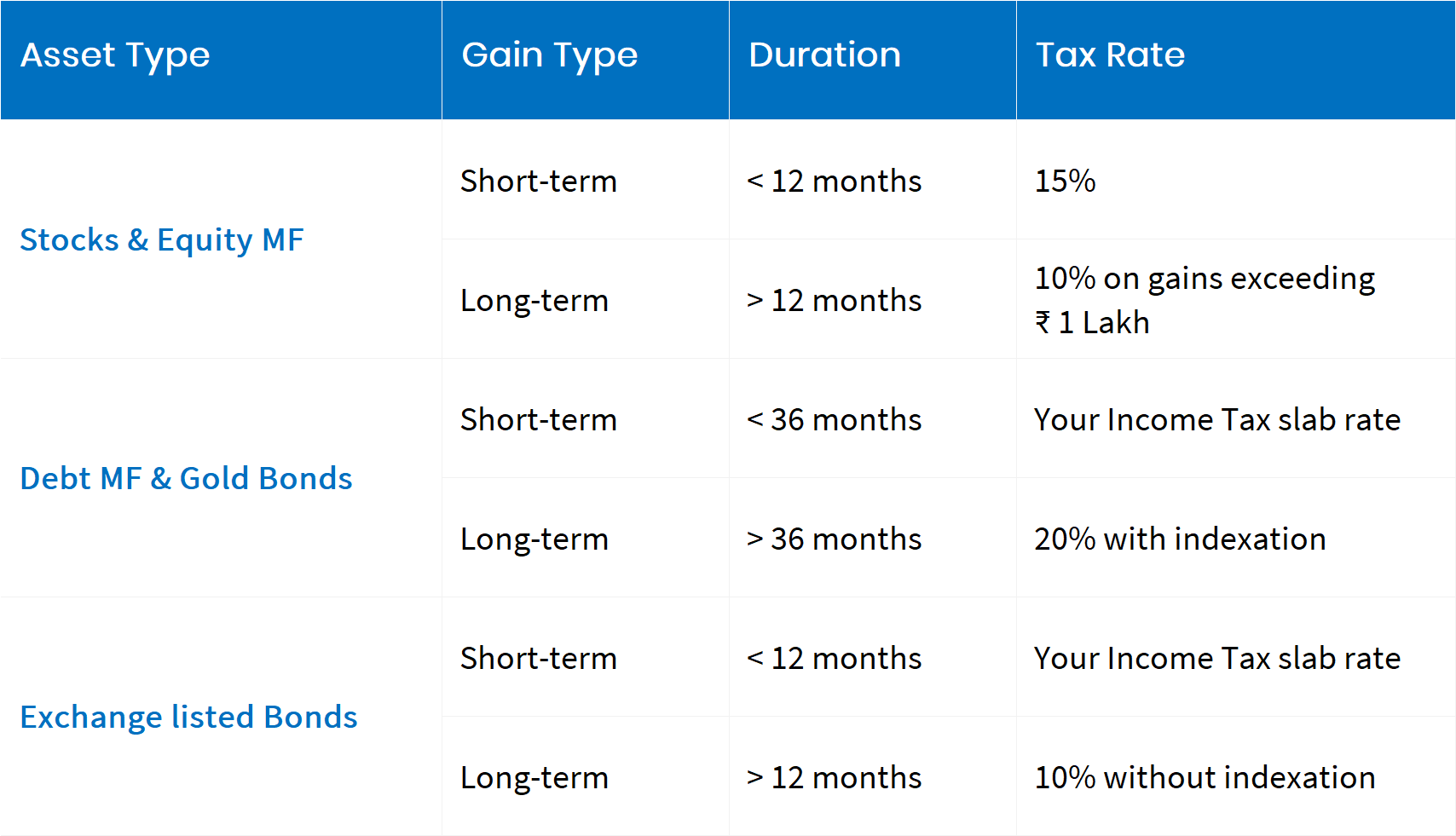

Capital Gains guidelines at a glance

Simple enough so far? Here’s some detail

Capital Gains must be computed using the First-In-First-Out method. Simply put, this means that when you sell your shares/units, you sell your oldest shares/units first and compute Capital Gains accordingly.

Second, you must account for any applicable corporate actions while computing Capital Gains for an asset. Corporate actions can include Bonus, Split, Merger or De-merger.

Now things get a bit tricky

Grandfathering of Long Term Capital Gains:

In 2018, a 10% LTCG tax was introduced on Stocks and Equity Mutual Funds with the condition that gains made until January 31st 2018 will not be taxed. This rule is what is referred to as the Grandfathering of Long Term Capital Gains.

On assets sold on or after April 1st 2018, long term capital gains are now subject to Grandfathering. This involves a set of complex calculations for each sale transaction. Things get especially complex in the case of Bonus, Merger, Demerger and Split transactions.

We won’t go into the detailed formulas here, but we are happy to inform you that MProfit computes Capital Gains by taking all Grandfathering rules into consideration.

Once you have imported your data to MProfit, simply generate your Capital Gain reports in Income-Tax-Return (ITR) format for Stocks or Equity Mutual Funds.

Indexation:

For Debt Mutual Funds and Gold Bonds, you should compute your Capital Gains as per India’s Cost Inflation Index (CII) to reduce your tax liability.

MProfit takes care of this automatically.

Your Capital Gain reports for Debt Mutual Funds and Gold Bonds in MProfit will use the latest CII numbers to provide Capital Gains with indexation, as per Income Tax guidelines.

Wait, there’s more!

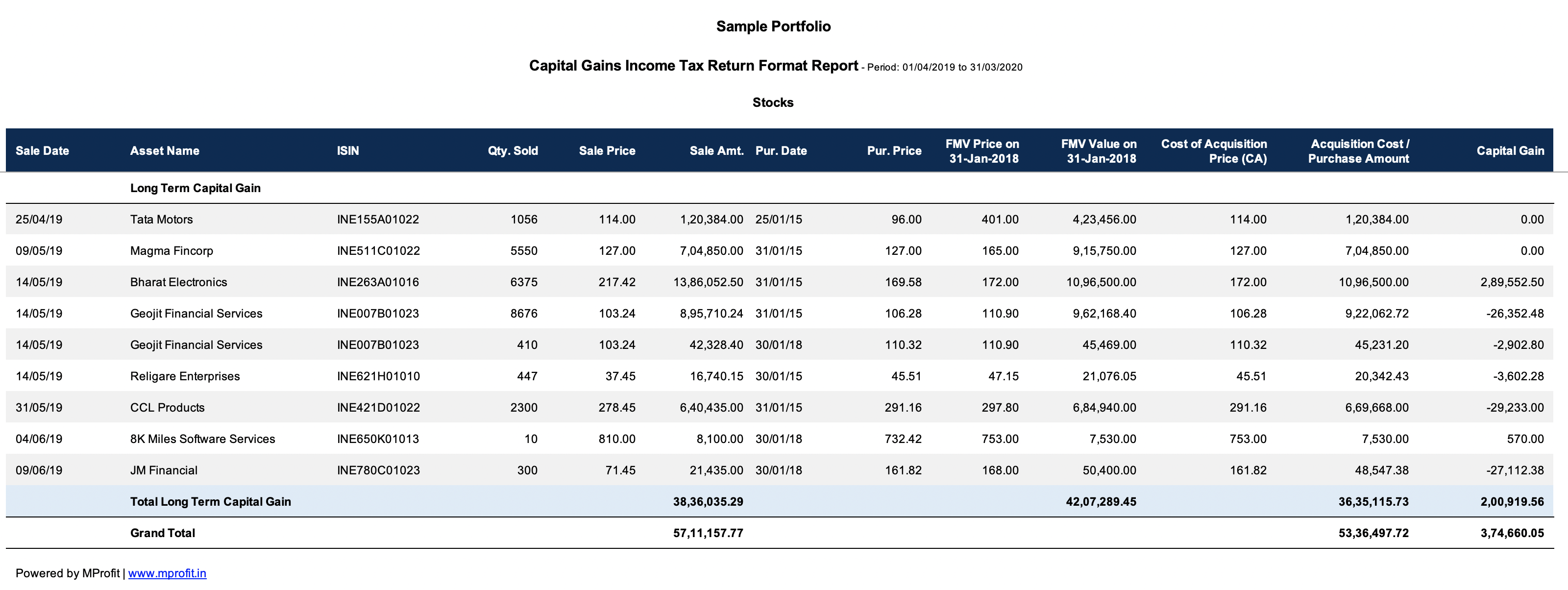

As per recent Income Tax guidelines, all investors must now include ISIN details while providing Capital Gains for tax filing.

MProfit’s Capital Gain reports include ISIN details for all Stocks, Mutual Funds & Traded Bonds.

Here’s what a sample Capital Gain report with ISIN details in MProfit looks like:

The final stretch

Once your Capital Gain reports are ready, your next requirement is to upload them to a tax filing software.

MProfit makes this process seamless.

We provide a generic Excel report in Income-Tax-Return format with ISIN details that you can customise as per your needs.

MProfit also provides you Capital Gain reports in formats compatible with popular tax software such as ClearTax, Winman, Spectrum and CompuTax.

Computing and processing your Capital Gains could not get any easier.

To learn more about MProfit’s features as an all-in-one portfolio management software:

Comments